BTC Price Prediction: Analyzing the Path to $117K and Beyond

#BTC

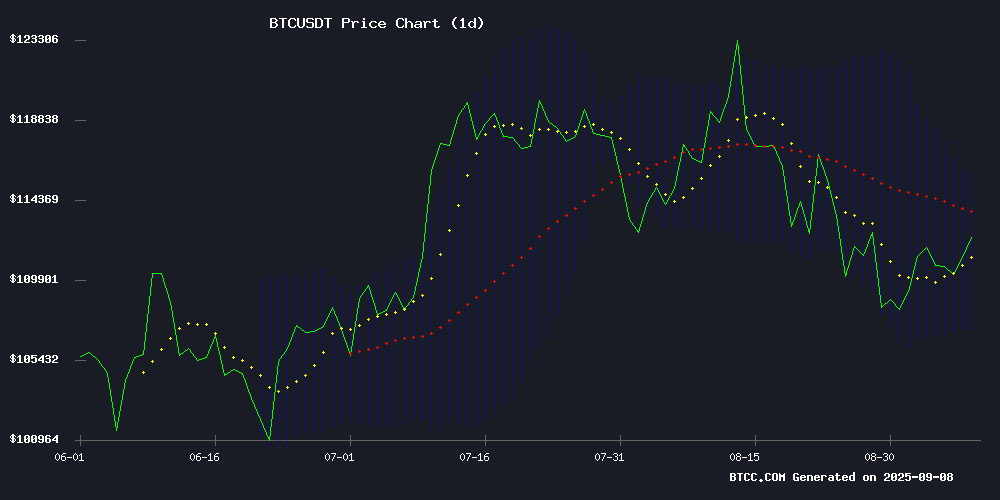

- Technical Resistance Levels: BTC faces immediate resistance at the 20-day moving average of $111,486, with upper Bollinger Band resistance at $115,891 serving as the next key level

- Institutional Accumulation: Corporate Bitcoin treasuries exceeding 1 million BTC with $1 billion weekly inflows provide strong fundamental support for higher prices

- Liquidation Catalyst: The $117,000 level represents a critical zone where $3 billion in short positions face liquidation risk, potentially accelerating upward momentum

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Moving Average

BTC is currently trading at $111,029, slightly below its 20-day moving average of $111,486, indicating potential resistance at this level. The MACD reading of -673.55 suggests short-term bearish momentum, though the price remains within the Bollinger Bands range of $107,080 to $115,891. According to BTCC financial analyst Olivia, 'The current technical setup shows BTC consolidating within a defined range. A break above the 20-day MA could trigger movement toward the upper Bollinger Band around $115,891, while failure to hold above $107,000 may signal further downside.'

Market Sentiment: Institutional Accumulation Offsets Seasonal Concerns

Market sentiment presents a complex picture with corporate Bitcoin treasuries surpassing 1 million BTC alongside seasonal September concerns. Positive developments include $1 billion weekly institutional inflows and Bitcoin's illiquid supply reaching historic highs, indicating strong accumulation. However, seasonal trends and liquidation risks around $117,000 create near-term headwinds. BTCC financial analyst Olivia notes, 'The fundamental backdrop remains strong with institutional adoption accelerating, though traders should monitor the $117K level where significant short positions face liquidation risk.'

Factors Influencing BTC's Price

Bitcoin Price Prediction 2025: Can BTC Deliver 25x Returns Post-Halving Cycle?

Bitcoin has reclaimed the spotlight as analysts debate its potential upside following the latest halving event. Historical patterns suggest that post-halving cycles often trigger exponential growth—raising the question of whether BTC can achieve 25x returns by 2025. The 2017 and 2021 cycles serve as benchmarks, with scarcity-driven rallies propelling prices to record highs. This time, the market anticipates a similar trajectory, potentially pushing Bitcoin into six-figure territory.

Post-halving consolidation has given way to fresh accumulation, with on-chain data revealing dwindling BTC reserves on exchanges—a bullish indicator of rising demand. Whales are positioning early, signaling confidence in a broader market uptick. Meanwhile, altcoins like MAGACOIN FINANCE are gaining traction, fueled by ROI speculation and community momentum.

Bitcoin Eyes $117K as $3B in Shorts Face Liquidation Risk

Bitcoin's uncharacteristic September calm may be nearing an inflection point. The cryptocurrency has traded in a tight range this month, mirroring historical patterns of muted activity. Yet derivatives markets now signal potential for a violent breakout, with analysts flagging $117,000 as a critical level that could liquidate over $3 billion in short positions.

Such a move would create a self-reinforcing cycle—forced buybacks from liquidated shorts could propel prices higher, potentially triggering additional liquidations. Market technicians note this setup has developed over weeks, requiring only modest buying pressure to ignite. The catalyst may emerge before the Federal Reserve's next policy decision, underscoring crypto markets' capacity for organic momentum shifts independent of macroeconomic developments.

Peter Schiff Renews Bitcoin Critique Following Gold’s Historic Surge

Gold's relentless rally has cast a shadow over Bitcoin's performance, with the precious metal surging to a record high above $3,586—a 36% year-to-date gain. Peter Schiff, a vocal gold advocate, seized the moment to underscore Bitcoin's weakness, noting an 18% decline against gold since mid-August. The cryptocurrency now teeters near bear market territory in gold terms, still 16% below its November 2021 peak ratio.

While Bitcoin maintains an 18% gain in USD this year, its failure to match gold's consistency as a store of value remains a focal point for critics. Schiff's remarks highlight the enduring debate between digital and traditional hedges, with gold's 85% five-year return serving as a benchmark for stability.

Arkham Discovers $5B in Bitcoin Linked to Movie2K Piracy Case Remains Unmoved Since 2019

Arkham Intelligence has uncovered 45,000 Bitcoin, valued at over $5 billion, still tied to the Movie2K piracy operation. The funds have remained dormant across more than 100 wallets since 2019, raising questions about German authorities' seizure strategy.

German police previously confiscated and sold nearly 50,000 BTC in early 2024 but failed to address this additional cache. The oversight has drawn criticism as Bitcoin's price has since doubled, potentially costing taxpayers billions in unrealized gains.

The revelation highlights ongoing challenges in tracking and managing seized digital assets. Market observers note the unmoved BTC represents one of the largest inactive holdings tied to legal proceedings.

CryptoAppsy Enhances Real-Time Crypto Market Engagement

CryptoAppsy emerges as a pivotal tool for cryptocurrency traders, offering instantaneous access to market data without the friction of account creation. The app's iOS and Android compatibility ensures broad accessibility, while its lightweight design belies robust functionality.

Real-time price tracking spans thousands of assets—from Bitcoin to emerging altcoins—aggregating global exchange data with millisecond latency. This enables users to capitalize on arbitrage opportunities and volatile swings. Historical charts are rendered through intuitive gestures, allowing data-driven strategy formulation.

Portfolio monitoring features deliver live valuation updates, though the excerpt cuts short before detailing this functionality. The platform's ability to curate personalized watchlists eliminates exchange-hopping, concentrating relevant assets on a single interface.

Corporate Bitcoin Treasuries Surpass 1 Million BTC with $1 Billion Weekly Inflow

Institutional Bitcoin adoption reached a milestone as corporate treasuries collectively crossed the 1 million BTC threshold this week. Between September 1-6, entities added 9,800 BTC worth approximately $1 billion at current prices, signaling accelerating institutional accumulation.

Three new entrants joined the treasury movement: a Dutch firm allocated 1,000 BTC following a $147 million capital raise, China's CIMG Inc acquired 500 BTC, and U.S.-based Hyperscale Data initiated its position with 3.6 BTC. Existing holders including MicroStrategy and Marathon Digital continued aggressive stacking, contributing to 8,339 BTC in expansions from 24 established players.

The treasury trend now demonstrates self-reinforcing momentum, with six additional firms announcing future Bitcoin allocation plans. Market observers note these developments coincide with growing recognition of BTC as a corporate reserve asset, particularly among tech and financial enterprises.

MARA Expands Bitcoin Treasury to $5.9 Billion Amid Market Volatility

Marathon Digital Holdings (MARA) has solidified its position as a dominant force in Bitcoin accumulation, reporting a treasury valuation of $5.9 billion as of August 31, 2025. The firm now holds 52,477 BTC—second only to MicroStrategy among public companies—after strategically adding to its reserves during a 6% price dip.

Despite Bitcoin's decline from $124,500 to $107,000 in August, MARA maintained relentless production, mining 705 BTC (22.7 BTC/day) while deploying all miners at its Texas wind farm. CEO Fred Thiel emphasized the opportunistic accumulation: "We reinforced our long-term conviction by expanding holdings beyond 52,000 BTC."

The company's energized hashrate reached 59.4 EH/s, reflecting operational discipline even as competitors faced capitulation. This growth underscores institutional Bitcoin adoption as a treasury reserve asset, with MARA emerging as a case study in countercyclical investment strategies.

Tether Denies Bitcoin Sell-Off Rumors, CEO Clarifies BTC Transfers to XXI Initiative

Rumors of Tether liquidating Bitcoin holdings for gold were dispelled by CEO Paolo Ardoino after a YouTuber misinterpreted quarterly reports. Clive Thompson's analysis suggested a 9,000 BTC reduction in Q2 2025, but Jan3 CEO Samson Mow attributed the movement to strategic transfers to Tether's long-term investment arm, XXI.

Internal data reveals 19,800 BTC were reallocated to XXI in June-July 2025, resulting in a net 10,424 BTC increase in Tether's position. Market observers note the incident underscores how on-chain transparency can fuel speculation without context.

Bitcoin Illiquid Supply Reaches Historic High as Accumulation Trend Persists

Bitcoin's illiquid supply has surged to a record 14.3 million BTC, representing 72% of the circulating 19.9 million coins. Long-term holders and cold storage investors continue to accumulate despite recent market volatility, signaling unwavering confidence in Bitcoin's value proposition.

The metric climbed steadily even after Bitcoin's 15% pullback from its $124,000 all-time high in mid-August. Net illiquid supply grew by 20,000 BTC in the past month alone, demonstrating persistent conviction among investors.

This tightening supply dynamic creates fundamental conditions for potential price appreciation when market sentiment improves. The trend underscores Bitcoin's evolving role as a preferred store of value rather than a speculative asset.

Bitcoin Faces Seasonal September Slump Despite Fed Rate Cut Expectations

Bitcoin enters its historically weakest month with a 3-5% average September decline, as 10 of the past 15 years saw negative returns. The cryptocurrency remains trapped below the $112,000 resistance level, confirming a bearish double-top pattern despite mounting anticipation of Federal Reserve easing.

August's dismal jobs report—showing just 22,000 new positions versus 75,000 expected—has cemented a 100% probability of September rate cuts. This follows startling revisions that turned June's job growth negative for the first time since July 2021, erasing 160,000 positions across two adjustments.

While October and November typically deliver 29% and 38% average BTC gains respectively, Treasury yield volatility may cap upside even after Fed action. The market now watches whether Bitcoin will follow its cyclical playbook of September weakness preceding Q4 rallies.

Bitcoin Price Prediction Today: Bearish and Bullish Targets Revealed

Bitcoin remains in a consolidation phase, oscillating between support at $106,700-$107,600 and resistance at $113,000-$113,500. Each dip into support has attracted buyers, while rallies face rejection at resistance—a classic sideways pattern until one level breaks.

Weekly charts maintain a bullish super trend signal, but a month-long bearish divergence warns of fading momentum. The 3-day MACD hints at a sluggish bullish crossover, suggesting traders await clearer signals.

A breakout above $113,500 could target $117,000, while failure to hold $106,800 risks deeper declines. Liquidation clusters at $113,800-$114,000 add volatility near key thresholds.

How High Will BTC Price Go?

Based on current technical and fundamental analysis, BTC shows potential for movement toward $117,000 in the near term, where significant short liquidations could accelerate upward momentum. However, the price faces immediate resistance at the 20-day moving average of $111,486. Key factors supporting higher prices include record institutional accumulation with corporate treasuries holding over 1 million BTC and weekly inflows exceeding $1 billion. Technical indicators suggest a trading range between $107,080 and $115,891 currently, with a break above the upper Bollinger Band potentially triggering a move toward $117,000.

| Price Level | Significance | Probability |

|---|---|---|

| $117,000 | Short liquidation zone | Medium-High |

| $115,891 | Upper Bollinger Band | Medium |

| $111,486 | 20-day Moving Average | High |

| $107,080 | Lower Bollinger Band | Medium |